Money Savvy Youth: Financial Literacy Curriculum Tips For Educators

Financial Literacy Curriculum Tips For Educators is a quarterly feature brought to you by EBALDC’s Money Savvy Youth program.

It’s back to school shopping time. For many families, back to school shopping can be challenging because they have a limited amount of money to spend. Sometimes, it’s necessary to distinguish between items that students need to buy and many things that they want to buy.

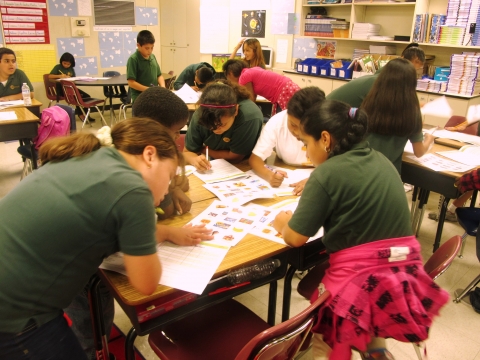

Use this handout to get students thinking about which things on their shopping list are wants and which things are needs. Remind students that they should buy the things they need for school before they buy the things they want for school, so they’ll be less likely to run out of money before they buy all the things they need.

You can pair this exercise with the words in the Financial Vocabulary Builders section below to introduce the words need and want, and then have a discussion about which items students think are needs versus wants.

There are some items such as beds, electricity, and books that might be needs or wants depending on your perspective. At least one of these items usually comes up. You can challenge students to think about what life situations would make these needs or wants. For example, you might not need books as an adult – although many people want them – but you do need books for school. So while you are in school, books are a need. In Western culture, beds are considered essential; it could be argued that they are a need. However, in many other countries in the world, people don’t sleep on beds and would never consider a bed a need, much less a want.

If you use this activity with your students, let us know how it went. Please share feedback, stories, and students’ shopping lists with MSY by scanning them and emailing them to repstein@ebaldc.org or mailing them to us at:

EBALDC c/o Rosalyn Epstein

1825 San Pablo Ave, Suite 200

Oakland, CA 94612

Financial Vocabulary Builders

Share these words with your students to build their financial vocabulary and comprehension.

Need. A need is something that is necessary for life and daily living.

Examples: Healthy food, water, shelter, clothes

Used in a sentence: Antwan thinks that healthy foods are a need because they make his body stronger.

Want. Wants make life more fun or comfortable.

Examples: Video games, toys, hot chips, Jordan shoes

Used in a sentence: Lin spends part of her allowance on hot chips which are a want, and part on pencils, which are a need for school.